Friday Links, December 10

- The ESG mirage. A great Businessweek piece on how popular ESG ratings driving trillions into sustainable investing have little connection with a company’s impact on the planet.

Here's a quick anecdote from my review of MSCI ratings related to workplace practices. There aren't that many indicators of this kind, but one is supposed to rate companies on employee involvement. It's a simple, 0-1 score (1=you're doing a good job). Amazon (Exhibit A for digital taylorism) and Nucor (the opposite) both get a “1.” So, yeah...

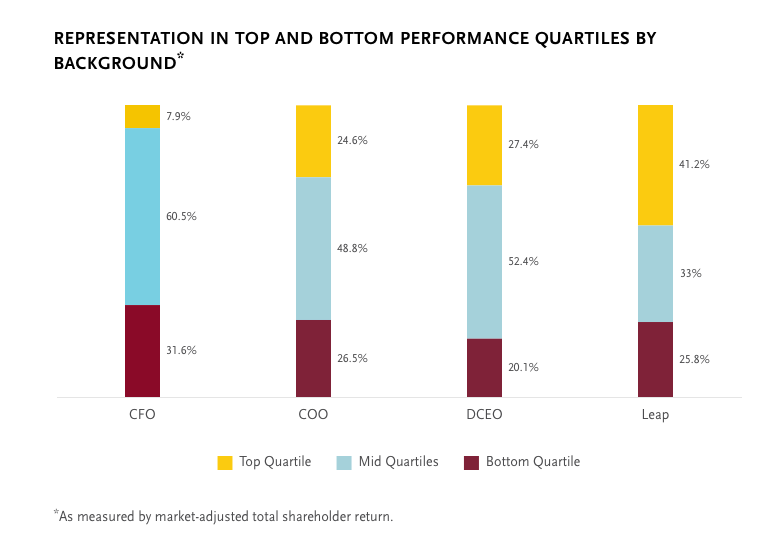

2. Finance types at the helm. S&P500 CEOs who were previously CFOs are by far the least likely to outperform their peers, accordingly to Spencer Stuart. I'd like to learn more about the methodology behind this chart, but I can't say I'm surprised...

3. Talent markets (again). Some large companies like Unilever and Seagate are experimenting with internal talent markets. Many vanguard organizations (e.g., Nucor, Haier, WL Gore) have long used these mechanisms to quickly match people with opportunities & reduce silo-ization. It's surprising how few have followed their lead.

The piece mentions new tools like Gloat, which can increase visibility and reduce friction. But the concept is nothing new, and it's ironic that IBM is described as a company where internal opportunities for talent are hard to find, since they had a decent internal market ~15 years ago.

The problem with internal talent markets, like internal markets for capital, ideas, and services, is more political than practical. These approaches threaten the prerogatives managers and administrators, who are therefore unenthusiastic about adopting them.

4. Getting canned via Zoom. The irony is that Better.com was recently certified as a "Great Place to Work."

5. Techno-optimism (for management?). This post about the reason to be excited about technological progress in the 2020s got me thinking about management innovation in the decade ahead. What's the equivalent of gene synthesis, brain-computer interfaces, or nanotech for how we run our organizations? Can we imagine a 10x improvement in management, intended as a social technology? We badly need organizations that are far more daring and resilient.